The Fall of FTX and the Future of Crypto

The Simple Scam That Brought Down an Empire

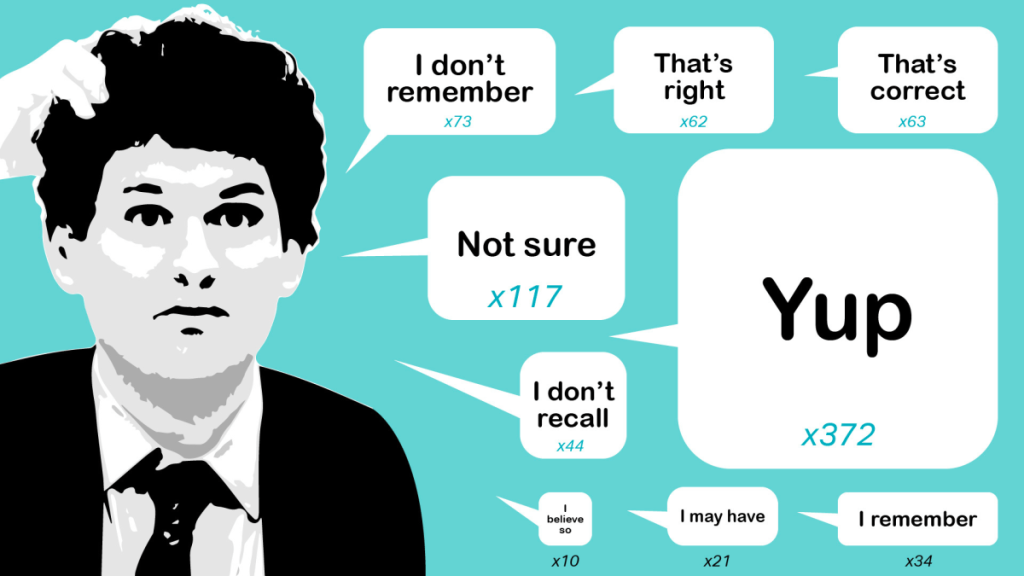

In a stunning turn of events, former FTX CEO Sam Bankman-Fried was sentenced to 25 years in prison by a federal judge on Thursday. The charges? Seven counts of wire fraud and money-laundering, stemming from a simple yet devastating scam involving customer deposits at FTX, Bankman-Fried’s cryptocurrency exchange, and his hedge fund, Alameda Research.

The scheme involved secretly funneling customer deposits from FTX to Alameda, which then used the funds for questionable investments, lavish real estate purchases, political campaign contributions, and, crucially, propping up FTX’s proprietary crypto token, FTT. The house of cards came tumbling down when a series of document leaks and investigative journalism by Coindesk, coupled with a well-timed tweet from rival exchange Binance‘s CEO Changpeng “CZ” Zhao, triggered a run on FTX. Billions in customer funds vanished almost overnight, though there is hope that a significant portion may be recovered.

The End of an Era and the Aftermath

Bankman-Fried’s sentencing marks the end of a tumultuous era in crypto, characterized by get-rich-quick schemes and promises of impossibly high returns on everything from digital art to obscure tokens. The aftermath has been a wave of fraud investigations and indictments, with even Binance’s CZ pleading guilty to money-laundering violations related to insufficient controls.

The Promise of a More Sober Future

Despite the recent turmoil, some crypto optimists, like Andreessen-Horowitz‘s Chris Dixon, believe that we are entering a more mature phase of crypto development. They argue that software developers will finally build useful applications on the various blockchains that have emerged since the creation of the original bitcoin blockchain in 2008.

The Problem with the Optimistic Outlook

The issue with this perspective is that developers have been building on platforms like Ethereum and Solana for years, yet the only economically viable purpose these applications have served is speculation. While it’s possible to create digitally authenticated art, its value lies not in its aesthetic merit but in the hope that someone else will buy it for more money later.

Many blockchain-based solutions, such as smart contracts and decentralized autonomous organizations (DAOs), simply replace existing systems that, while imperfect, are not so inefficient as to paralyze the economy. The question remains: where is the killer app for blockchains? Where is the runaway success story?

The Lack of Profitable Blockchain Startups

To date, there hasn’t been a single blockchain-based startup with enough cashflow or profitability to go public. While there are bitcoin mining companies like Riot and crypto trading facilitators like Coinbase and Block (formerly Square), no company has developed significant economic value by doing something brand new or better on a blockchain.

The Future of Crypto: Back to Basics?

In my view, crypto will likely revert to the original function of Bitcoin as an alternative to nation-based currencies for storing and exchanging value. While its volatility may not make sense in stable economies, it remains a viable option for preserving wealth in countries facing runaway inflation, corrupt governance, civil unrest, or war. Bitcoin’s utility also extends to sending remittances without exorbitant fees and, sometimes, as a digital substitute for cash in underground economic activities.

Why bitcoin over newer coins? Because most other coins are based on faith, trust, and pixie dust, with their value assigned by those who hold and trade them. In contrast, bitcoin is backed by something real and tangible: energy. Due to its proof-of-work model, creating and validating new bitcoins requires energy consumption, whether from burning natural gas or tapping into a nearby nuclear plant. As energy drives the real-world economy, it will remain a valuable asset for the foreseeable future. If bitcoin demand stabilizes, its price should theoretically track the price of electricity.

It wouldn’t surprise me in the least if Satoshi had some kind of connection to the energy industry.

5 Comments

Oh, so now that SBF’s been caught, everyone’s a financial ethicist!

Guess it’s time for the crypto world to grow up and face the music, isn’t it

SBF hitting the slammer marks the end of crypto’s Wild West era, does regulation loom on the horizon

SBF’s downfall might just be the plot twist the crypto saga needed, huh

Oh, the crypto circus finally faced its ringmaster’s finale, what next, a redemption arc