Embracing YNAB: A Journey Towards Financial Self-Actualization

The Allure of Free Money Management Tools

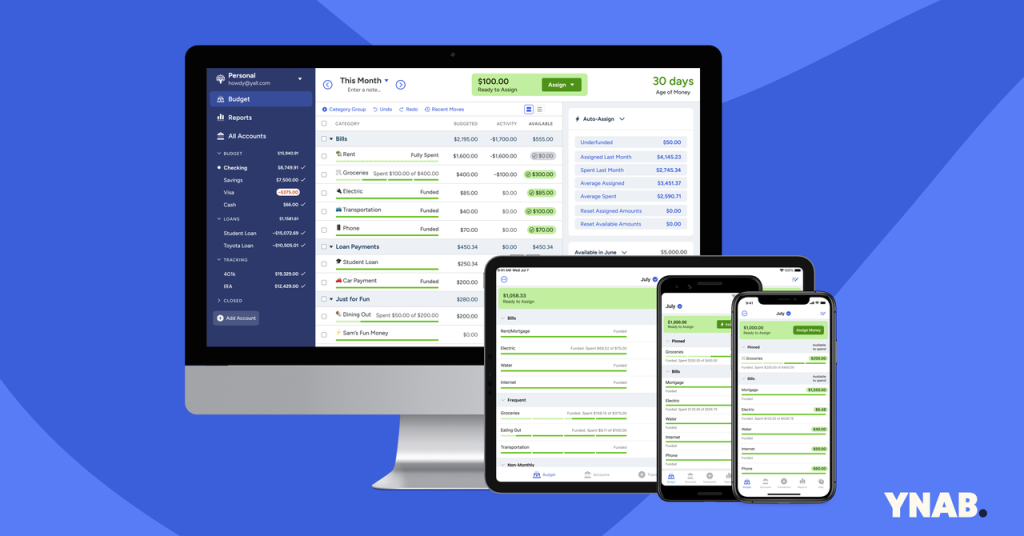

In the quest for financial savvy, many individuals, myself included, gravitate towards free money management tools like Mint. After all, it’s a common belief that those who excel at managing their finances opt for complimentary resources. By most standards, I consider myself relatively adept at handling money. I consistently pay my mortgage, allocate funds for vacations and savings, and maximize my retirement account contributions. Even if my checking account occasionally runs low, I never completely deplete it. Despite the absence of long-term financial planning, this approach has seemingly sufficed.

The Psychological Aspects of Money Management

When Intuit announced the impending closure of Mint last year, countless users, including myself, found themselves emotionally invested in their chosen money management software. This attachment stems from the fact that effective budgeting tools not only address the mathematical aspects of financial planning but also tackle the psychological hurdles associated with money.

In a society that often equates one’s salary with personal worth, money evokes a myriad of complex emotions. Rather than ignoring these mental obstacles, YNAB empowers users to acknowledge and plan around them. As YNAB’s founder, Jesse Mecham, wisely states:

“Guilt is useful. But if it sticks around for too long, it turns into shame, and that’s destructive. Whenever we get someone into our grips at YNAB, they try so hard to tell us about all these things in the past. And we can just say, ‘No, no, we’re looking forward. How much money do you have in your bank account right now?’ I hope people feel that when they interact with us, there’s a lot of grace. There’s a lot of room to be yourself, and to not even be totally happy with how things are, but feel like you can change it.”

YNAB: A Tool for Self-Actualization

YNAB transcends the realm of mere money management; it serves as a catalyst for self-actualization. It prompts users to reflect on their aspirations and explore how their financial resources can facilitate the realization of those goals. For some individuals, a simpler system may suffice, particularly if their income comfortably supports their desired lifestyle, such as becoming a well-traveled person, constructing their dream home, or retiring at 55.

As for myself, I will continue to meticulously examine my transactions and devise strategies to fulfill my ambition of witnessing orcas in their natural habitat. YNAB will be my steadfast companion on this journey, guiding me towards becoming the orca watcher I aspire to be.

4 Comments

Planning your finances without a budget is like baking without a recipe – expect some unpredictable results!

Having no budget is like driving with your eyes closed – thrilling but disastrous!

A budget? Think of it as the GPS for navigating the wild roads of your finances, without it, good luck finding your way!

Ever tried guessing your way through a maze? That’s your financial future without a budget!